The Complete Guide to Breakout Trading

The idea with breakout trading is to enter a trade just as a stock's momentum is picking up and it's breaking new highs. The last thing you want to do is jump in too late and stay for too long because of FOMO. Stick to a trading plan. A good trading plan will include an entry/exit strategy and trading goals.

How to Take Advantage of The Breakout Trading Strategy

Okay, the stage two breakout trader waits patiently until the price clearly breaks out of the zone. There is believed to be a support zone around the area from $92 to $96. The candle shown clearly went all the way down to $88, which was when the breakout trader sold. The price when down and then came back into the range.

The Best Breakout Trading Strategy Trade Room Plus

Changing Traders' Lives By Teaching Them How To Earn Consistent Cashflow. 816 Ligonier Street #405 Latrobe, PA 15650. (724) 374-8352. [email protected]. Legal Disclaimer. In today's article, we're going to talk all about the best breakout trading strategy used by professional traders to trade breakouts.

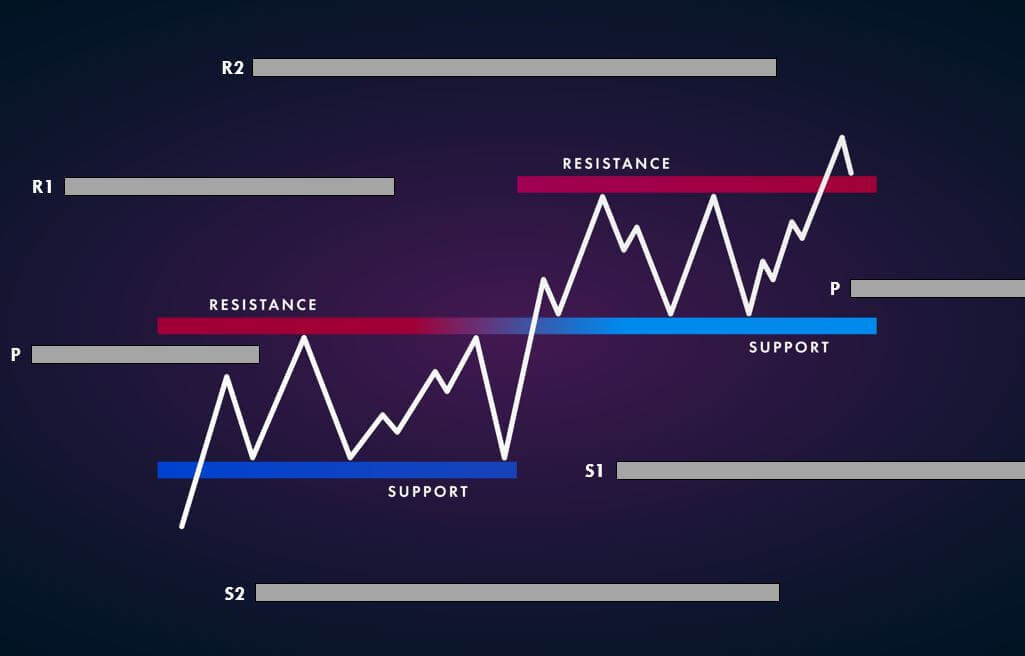

96. Trading Breakouts using Pivot Points Forex Academy

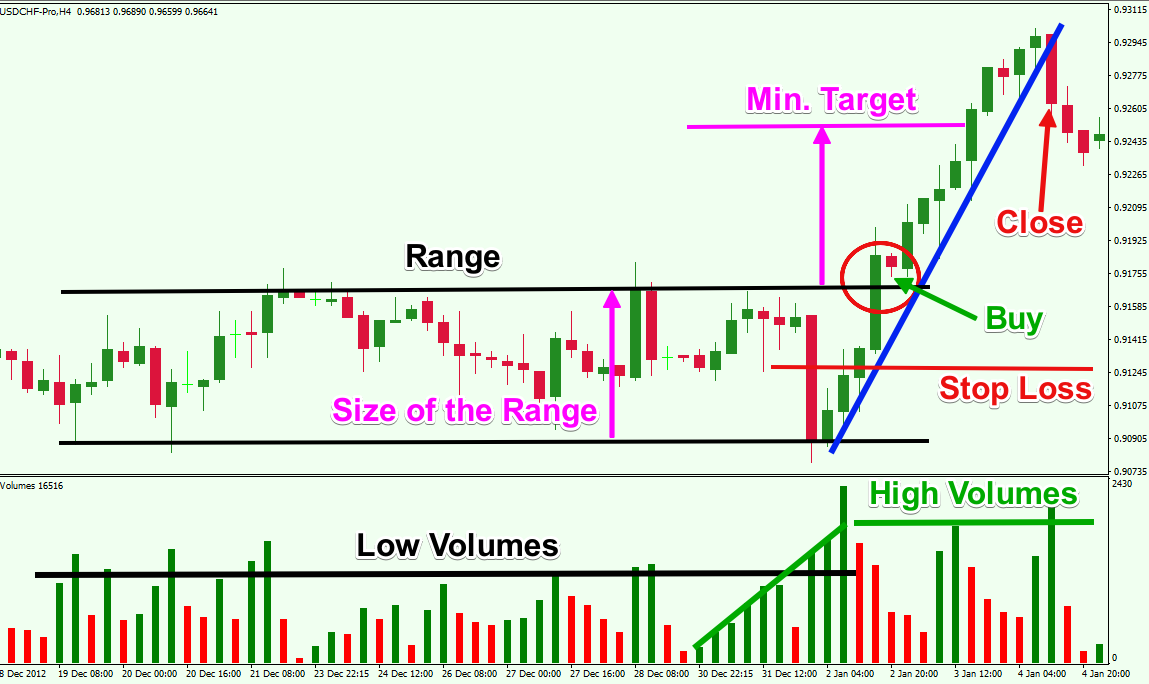

Breakout trading is a straightforward strategy that traders use to capture the significant moves a stock makes when it crosses a defined boundary, known as support or resistance, with a noticeable increase in trading volume. Think of it as watching for the moment a sprinter bursts off the blocks — the strategy involves entering the race at.

The Complete Guide to Breakout Trading

What is an intraday breakout? When you zoom in, using the 1-hour timeframe or lower, you'll be trading intraday. The breakout principles are the same in any timeframe. Sometimes there are unique intraday opportunities around specific assets, times, etc. For example, you can build an intraday breakout trading strategy around Chinese stock indices.

rangebreakouttradingexample Forex Training Group

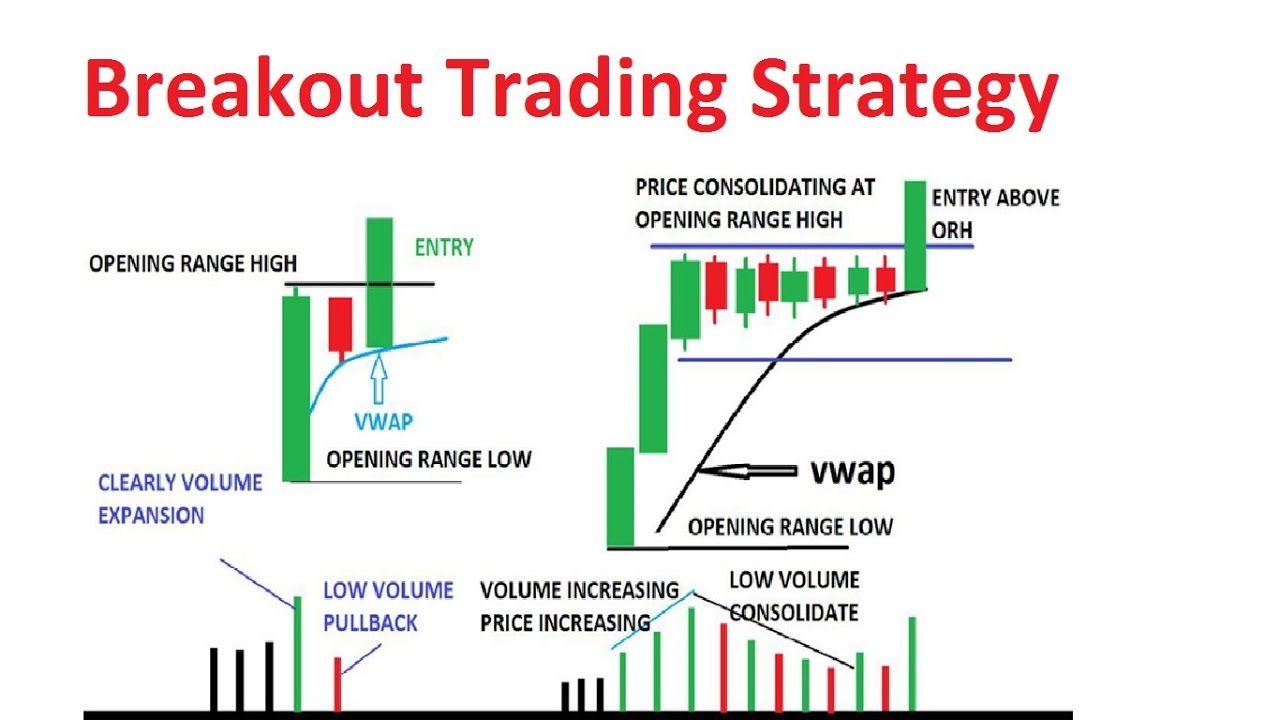

Breakout Trading Strategy: The Trend Trading Breakout. Here's the deal: In a strong trend, the price tends to stay above the 20-period Moving Average. So if you're waiting for a pullback, then you'll be disappointed as the market continues making new highs — without you.

:max_bytes(150000):strip_icc()/dotdash_Final_The_Anatomy_of_Trading_Breakouts_Jun_2020-04-b83064c68c16499b8d92602a438bc58f.jpg)

The Anatomy of Trading Breakouts

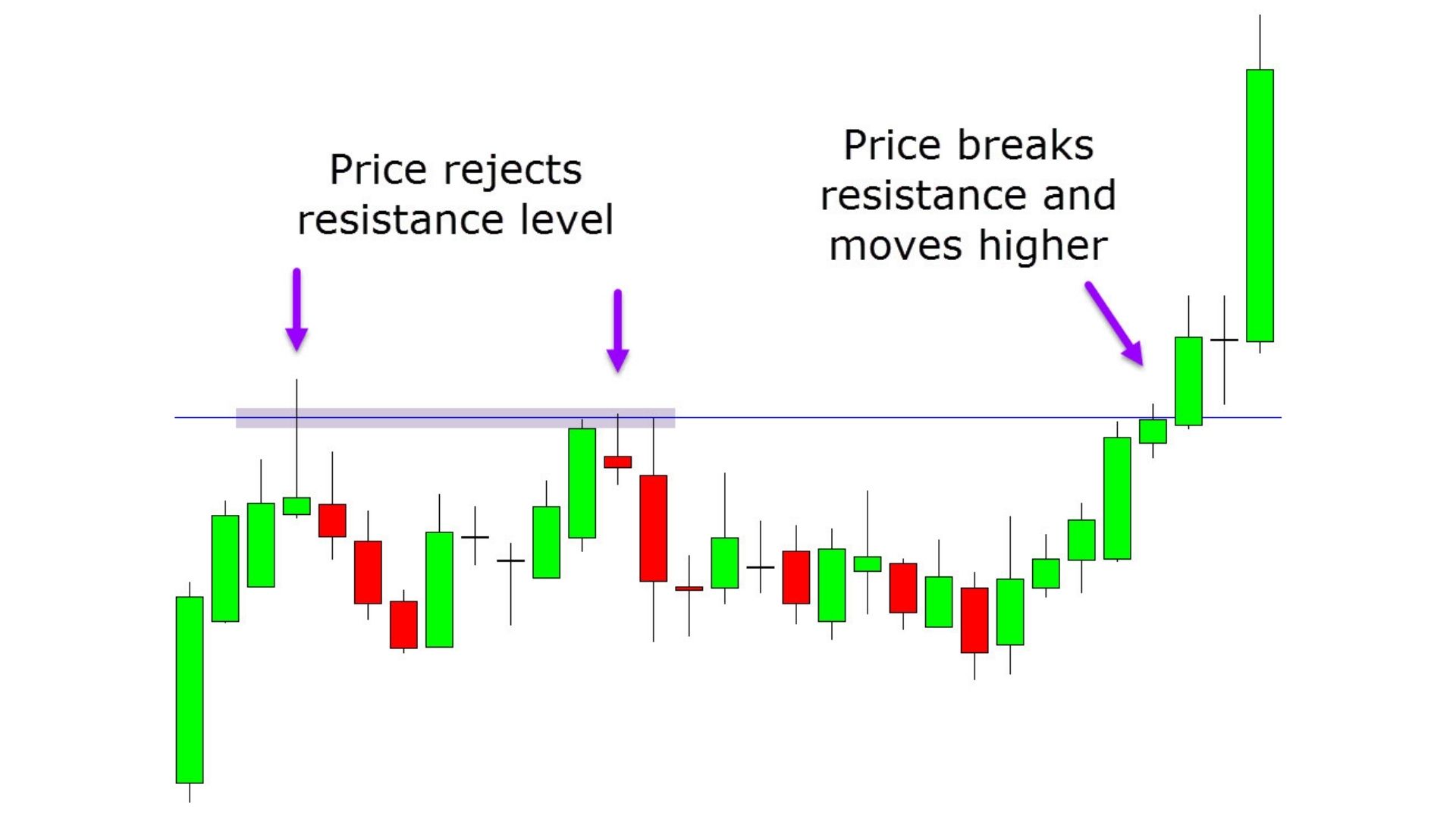

Breakout trading is a popular strategy used by traders in the financial markets to capitalize on significant price movements. It involves identifying key levels of support and resistance and taking advantage of breakouts, where the price breaks through these levels, indicating a potential trend reversal or a continuation of an existing trend.

Breakout Trading Strategy Quick Guide With Free PDF

A breakout is the movement of the price of an asset through an identified level of support or resistance.. He has been a professional day and swing trader since 2005. Cory is an expert on stock.

The Complete Guide to Breakout Trading

Intraday breakout trading is a dynamic strategy that is widely embraced by traders seeking to profit from short-term price fluctuations within a single trading day. This breakout strategy hinges on identifying and capitalizing on significant price movements, particularly when an asset's price breaks either the highest or lowest level it has.

BREAKOUT TRADING STRATEGY It's so easy! 🔥📈 YouTube

Breakout trading is a strategy used by active investors to take advantage of significant price moves in the early stages of a trend. A breakout occurs when the price of an asset moves above a resistance level or below a support level with increasing volume. This strategy can signal future volatility expansions and major price trends if managed.

The 3 Types of Breakouts in Trading SurgeTrader

Breakout trading is a common technique used by traders of all experience levels. In this article, we'll explain what breakout trading is, offer some tips for breakout trading, and show a simple strategy a trader can use as a basis to start trading breakouts.

Breakout Trading Strategy Used By Professional Traders

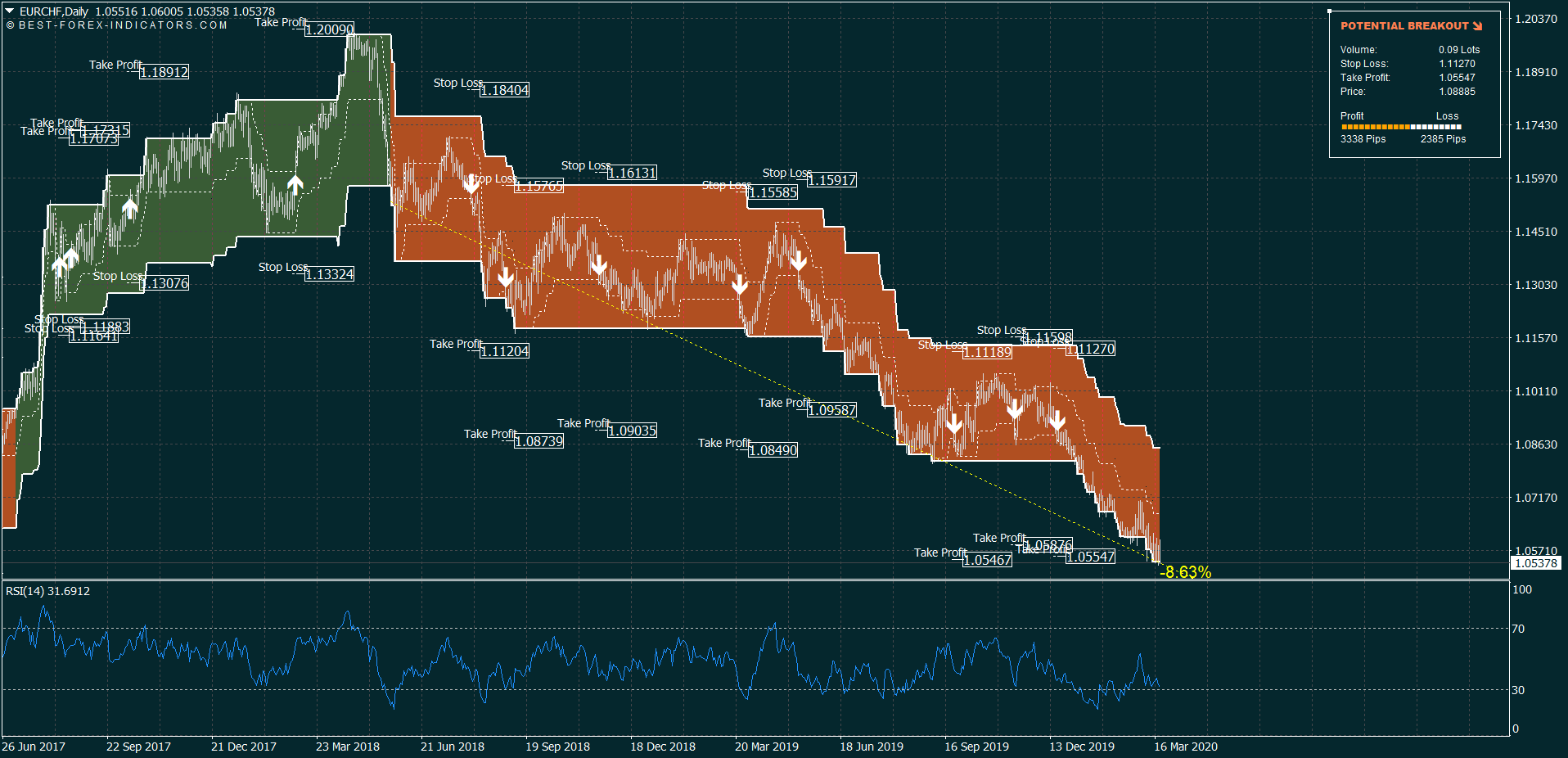

A breakout is when the market moves above a resistance or below a support level, and indicates that prices may continue in the direction of the breakout. However, while trading breakouts may seem very compelling, most of them end up as false breakouts, commonly called "fake-outs". This means that the market turns around and that the.

Breakout Strategy For Binary Options Trading VIP Trading Official

A breakout strategy aims to enter a trade as soon as the price manages to break out of its range. Traders are looking for strong momentum and the actual breakout is the signal to enter the position a nd profit fro m the market movement that follows. Traders may enter the positions in the market, which means they will have to closely monitor the.

Breakout Trading Strategy My Secret Method YouTube

A breakout trader tries to spot a breakout, which is when the price of a security rises above or drops below a range in which it has been oscillating. This range is usually bound by support and resistance levels, though some traders use other levels based on the Fibonacci sequence or other indicators. A support level is a low that a security.

The Complete Guide to Breakout Trading

Breakout Trader: A type of trader who uses technical analysis to find potential trading opportunities, identifying situations where the price of an asset is likely to experience a substantial.

Breakout Trading Simple Introduction for Beginners BestForex

A breakout is when a stock price moves outside a defined support or resistance level with increased volume. Following this, a breakout strategy is a popular trading approach used by active traders to take a position within this trend's early stages. This strategy is often the starting point for large price moves and increased volatility.